Financial aid can be used for off-campus housing if it is considered a legitimate education-related expense. Many universities allow students to use their financial aid for housing costs, whether on or off-campus.

It’s important to review your school’s financial aid policies and consult with the financial aid office to determine the eligibility and specific requirements for using financial aid for off-campus housing. When students decide to attend college, they are often faced with the decision of whether to live on campus or off campus.

While some students choose to live in campus housing, others may prefer the independence and flexibility that comes with off-campus housing. However, the cost of living off-campus can be a concern for many students, and financial aid can play a crucial role in helping them afford suitable housing options. Understanding the guidelines for using financial aid for off-campus housing is essential for students seeking financial support for their living arrangements.

Exploring Financial Aid Eligibility

Understanding financial aid eligibility is crucial for students planning to live off campus. Financial aid can help cover various college expenses, including tuition, textbooks, and even housing. While most people associate financial aid with on-campus dormitories, it is also possible to use financial aid for off-campus housing. In this section, we will explore the types of financial aid available and the criteria for qualifying for financial aid.

Types Of Financial Aid

Financial aid comes in different forms, and each type has its own eligibility requirements. Here are some common types of financial aid that students can consider for off-campus housing:

- Pell Grants: Pell Grants are need-based grants awarded to undergraduate students. These grants do not need to be repaid and can be used for various costs, including housing.

- Student Loans: Students can also utilize student loans to help with off-campus housing expenses. These loans typically come with low interest rates and flexible repayment terms.

- Scholarships: Scholarships are another type of financial aid that can assist with off-campus housing costs. They are awarded based on merit, academic achievements, and various other criteria.

- Work-Study Programs: Work-study programs provide students with part-time job opportunities on-campus or in the community. The earnings can be used to cover housing expenses.

- State and Institutional Aid: Many states and colleges offer their own financial aid programs specifically designed to assist students with housing costs.

Criteria For Qualifying For Financial Aid

To be eligible for financial aid, students must meet certain criteria. Here are the primary factors considered in determining financial aid eligibility:

- Financial Need: Financial aid programs typically consider a student’s financial need as the primary factor. This is evaluated based on the student’s and their family’s income, assets, and expenses.

- Enrollment Status: Most financial aid programs require students to be enrolled at least half-time in an approved educational program.

- Achievement and Merit: Some scholarships and grants may require students to demonstrate exceptional academic achievements or talents in specific areas.

- Citizenship Status: Many financial aid programs are available only to U.S. citizens or eligible non-citizens.

- Academic Progress: Financial aid eligibility may also depend on maintaining satisfactory academic progress, such as meeting GPA requirements and completing a minimum number of credits each semester.

- Other Personal and Demographic Factors: Certain financial aid programs may consider other factors, such as being a first-generation college student, belonging to an underrepresented group, or demonstrating financial hardships.

Understanding Off-campus Housing

Off-campus housing refers to renting a place outside the confines of a university or college campus. This housing option is increasingly popular among students seeking independence and a more homelike environment during their academic journey. However, there are some factors to consider when deciding between off-campus housing and on-campus options. Let’s delve into the pros and cons of off-campus housing and compare costs with on-campus housing.

Pros And Cons Of Off-campus Housing

- Pros:

- Privacy and freedom

- Potentially lower costs

- Greater living space

- Opportunity to develop life skills

- Cons:

- Potential isolation

- Added responsibilities (maintenance, bills)

- Increased commute time

- Lack of campus resources and amenities

Cost Comparison With On-campus Housing

When comparing off-campus housing with on-campus options, it’s important to consider more than just monthly rent. Additional factors to include in the cost comparison are utilities, transportation, and meal expenses. It’s essential for students to evaluate the overall financial impact in both scenarios to make an informed decision.

Financial Aid Usage Regulations

Financial aid usage regulations play a crucial role in determining how students can utilize their aid to cover living expenses, including off-campus housing. Understanding the rules and restrictions around the use of financial aid for housing is essential for students seeking to make informed decisions about their living arrangements while in college.

Use Of Financial Aid For Living Expenses

When it comes to using financial aid for living expenses, including off-campus housing, students are allowed to allocate a portion of their aid to cover these costs. This can be a helpful option for those who prefer to live independently or need to reside off campus due to specific circumstances.

Restrictions On Using Aid For Housing

Despite the flexibility in using financial aid for living expenses, there are restrictions on the specific ways in which aid can be utilized for housing. It’s important for students to note that financial aid cannot be used for luxury housing options or extravagant living arrangements. The aid is intended to support basic living needs, and extravagant or unnecessary expenses are not considered eligible for coverage using financial aid funds.

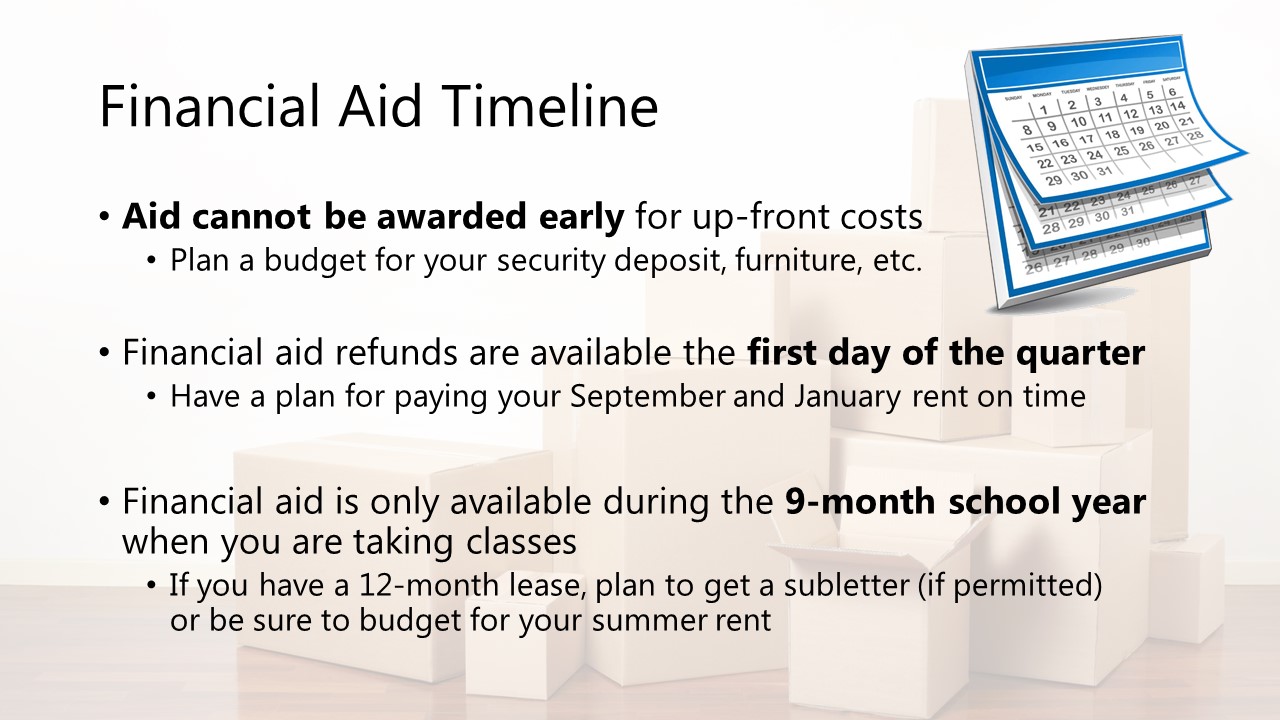

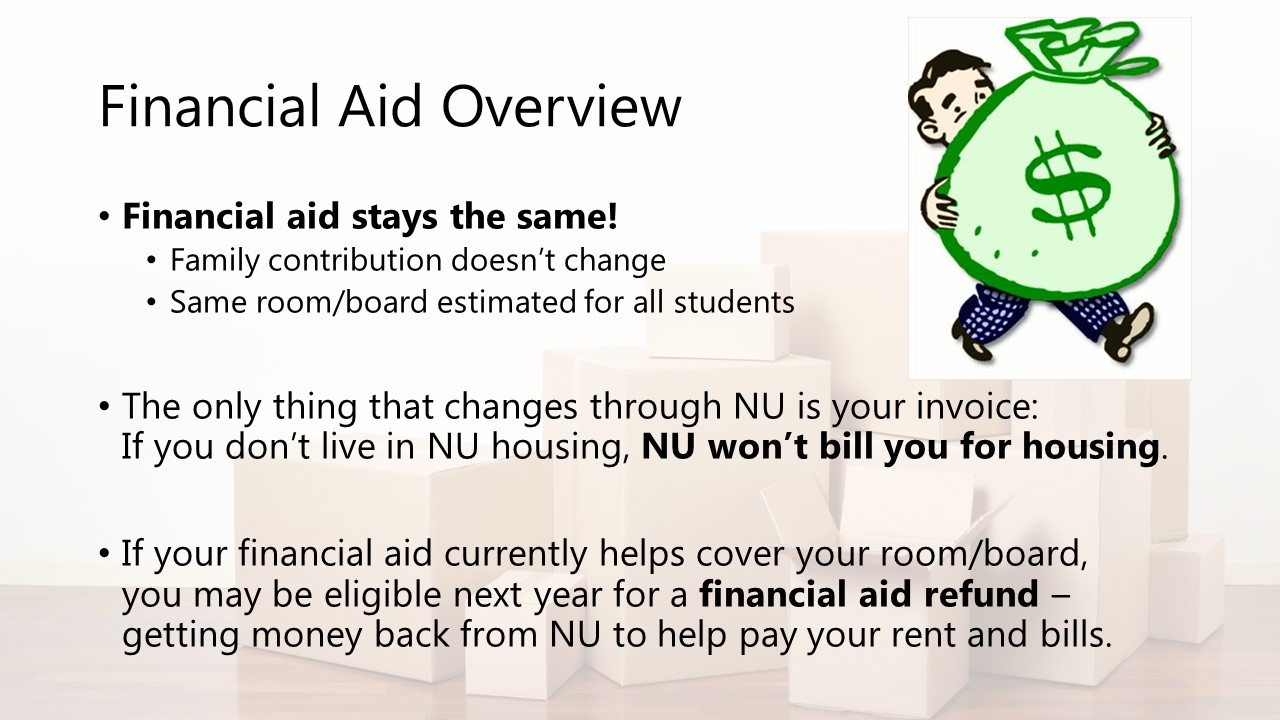

Credit: undergradaid.northwestern.edu

Navigating The Cost Of Living Off-campus

Navigating the cost of living off-campus can be challenging for students, especially when it comes to budgeting for expenses such as rent, utilities, and other additional costs. Understanding how to manage these expenses while using financial aid can make a significant difference in a student’s financial situation. In this article, we will explore the key aspects of renting and utilities considerations, as well as budgeting for additional expenses when exploring off-campus housing options.

Rent And Utilities Considerations

One of the primary expenses to consider when living off-campus is rent. Finding an apartment or house that fits your budget is crucial. Here are a few factors to take into account when considering the cost of rent:

- Location: Apartments closer to campus tend to have higher rental prices, so consider how much you are willing to spend versus the convenience of living near your classes.

- Roommates: Splitting the rent with roommates can significantly lower your individual housing costs, making it more affordable overall.

- Lease Length: Longer lease terms may offer reduced monthly rates, so consider if you plan to stay for an extended period and whether the lower rate justifies the commitment.

- Utilities: It’s important to factor utilities into your budget. While some landlords may include utilities in the rent, others may require you to pay them separately. Be sure to inquire about the average cost of utilities in the area.

Budgeting For Additional Expenses

Aside from the cost of rent and utilities, there are additional expenses to consider when living off-campus. These expenses can quickly add up, so it’s essential to budget accordingly. Here are a few examples:

- Furniture and Appliances: Unlike on-campus housing, off-campus options may require furnishing and equipping your living space. Budget for essential items such as a bed, desk, chairs, kitchen utensils, and appliances based on your needs.

- Internet and Cable: Having internet access and cable TV can be essential for academic and leisure purposes. Research the available service providers in your area to estimate the monthly cost.

- Transportation: If living farther from campus, you may need to budget for transportation costs such as gas, car insurance, or bus fares.

- Groceries and Meals: Allocate funds for groceries and meals that you will be responsible for preparing. Eating out less frequently and planning your meals can help stretch your budget.

- Renter’s Insurance: Protecting your belongings with renter’s insurance is a wise investment. Research insurance providers and include the cost of coverage in your monthly budget.

By considering all these factors, you can create a comprehensive budget that aligns with your financial aid and ensures a comfortable living situation while attending college. Remember, financial aid can be used for off-campus housing, but it’s crucial to plan and manage your finances wisely to make the most out of your resources.

Strategies To Manage Housing Costs

Explore effective strategies for managing housing costs, including the eligibility of using financial aid for off-campus housing. Discover ways to budget, prioritize expenses, consider roommates, and seek out affordable options. Find out how financial aid can potentially be allocated towards off-campus housing to alleviate housing-related burdens.

Seeking Alternative Housing Options

Consider exploring various off-campus housing options to find affordable alternatives. Roommates and shared living spaces can help split costs, while researching different neighborhoods may reveal more cost-effective options.

Utilizing Budgeting Tools

Use online budgeting tools or apps to track income and expenses. Setting a monthly budget for rent, utilities, and other living expenses can help manage finances effectively.

Credit: collegemoneytips.com

Impact On Academic Performance

Living off-campus can significantly impact a student’s academic performance. Let’s delve into how housing stability and balancing work and study play roles.

Effect Of Housing Stability On Studies

Secure housing directly relates to academic success due to reduced stress and distractions.

- Stable housing leads to higher focus on studies.

- Less worry about housing issues means more time for studying.

Balancing Work And Study

Juggling work and study can impact grades and overall academic performance.

- Limited hours for both work and study can lead to burnout.

- Balancing responsibilities is crucial for academic success.

Seeking Additional Financial Support

When it comes to off-campus housing, the cost can quickly add up, leaving many students wondering if their financial aid can be used to cover these expenses. The good news is that there are options available for students seeking additional financial support outside of their typical financial aid package. In this blog post, we will explore two key avenues for securing financial assistance for off-campus housing: scholarships and grants, and part-time employment opportunities.

Scholarships And Grants For Housing

When it comes to finding financial aid for off-campus housing, scholarships and grants specifically geared towards housing expenses can be a game-changer. Many organizations and institutions offer these types of financial aid options to help students afford the cost of living off-campus. Depending on your eligibility and the specific criteria set by each scholarship or grant, you could receive a significant amount of financial support.

Part-time Employment Opportunities

In addition to scholarships and grants, part-time employment opportunities can be another valuable resource for securing financial assistance for off-campus housing. By working a part-time job, you can earn income that can go towards covering your rent, utilities, and other living expenses. This option allows you not only to support yourself financially but also to gain practical work experience that can further enhance your resume.

There are numerous part-time employment opportunities that are suitable for students. Some examples include working at the university library, being a teaching assistant, or finding an on-campus job. These positions often offer flexible hours to accommodate your academic schedule and provide a steady source of income.

Remember, when exploring part-time employment opportunities, it’s essential to balance your work and academic commitments to ensure you can manage your responsibilities effectively. By finding the right part-time job, you can offset some of the financial burdens associated with off-campus housing.

Credit: undergradaid.northwestern.edu

Frequently Asked Questions Of Can Financial Aid Be Used For Off Campus Housing

Do You Get More Money From Fafsa If You Live Off Campus?

Living off campus doesn’t directly increase FAFSA money. The amount depends on your financial need and cost of attendance.

Can Federal Pell Grant Be Used For Off Campus Housing?

Yes, federal Pell Grants can be used for off-campus housing expenses.

How Do College Students Afford To Live Off Campus?

College students afford to live off campus by working part-time jobs, getting financial aid, splitting rent with roommates, budgeting wisely, and utilizing resources like scholarships.

Can You Use Fafsa For Living Expenses?

Yes, you can use FAFSA for living expenses such as housing, food, and transportation while attending college.

Can Financial Aid Cover Off-campus Housing Expenses?

Yes, financial aid can usually be used for rent, utilities, and other off-campus housing costs.

Conclusion

Securing financial aid for off-campus housing can be a viable option for students. By exploring various options such as scholarships, grants, and work-study programs, students can find assistance for their housing needs. It is crucial to conduct thorough research and understand the specific guidelines and eligibility criteria to ensure a smooth process.

With careful planning and determination, financial aid can help ease the burden of off-campus housing expenses for students.