Financial statements can be generated from the balance sheet, income statement, and cash flow statement. These documents provide valuable insights into a company’s financial performance, including its assets, liabilities, revenues, and expenses.

By analyzing the information contained in these statements, stakeholders can make informed decisions about the company’s financial health and potential for future growth. The preparation of financial statements is a crucial aspect of financial reporting for any business. It involves the compilation of data from various financial records and transactions to present a comprehensive overview of the company’s financial position and performance.

Investors, creditors, and other stakeholders rely on these statements to assess the company’s profitability, solvency, and overall financial stability. We will explore the key components of financial statements and their importance in financial analysis.

Importance Of Financial Statements

Financial statements play a crucial role in providing insights into the financial health and performance of a company. They are important tools that help stakeholders make better decisions, evaluate performance, and ensure financial transparency. Let’s explore some key reasons why financial statements are so vital in the business world.

Better Decision Making

Financial statements are invaluable for making sound business decisions. By analyzing financial data such as cash flow statements, balance sheets, and income statements, decision-makers can gain a comprehensive understanding of the company’s current financial position and its future prospects.

- Financial statements provide relevant data that can guide investments, expansion plans, and strategic decisions.

- Trends and patterns revealed in financial statements can help identify potential risks, which can aid in risk management and mitigation strategies.

- Comparing financial statements with industry benchmarks allows decision-makers to identify areas of improvement and implement necessary changes to enhance the company’s performance.

Evaluating Performance

Evaluating a company’s performance is another critical aspect that financial statements address. By closely examining financial reports, stakeholders can assess the efficiency and profitability of the company.

- Income statements reveal the company’s revenue, expenses, and profitability over a specific period, enabling stakeholders to gauge the company’s financial performance.

- The balance sheet provides an overview of the company’s assets, liabilities, and equity, offering insights into its financial standing and ability to meet financial obligations.

- Cash flow statements highlight the inflow and outflow of cash for a given period, ensuring stakeholders can identify the company’s liquidity and solvency.

By assessing the company’s financial health through various indicators, stakeholders can make informed decisions and take appropriate actions to drive the company towards success.

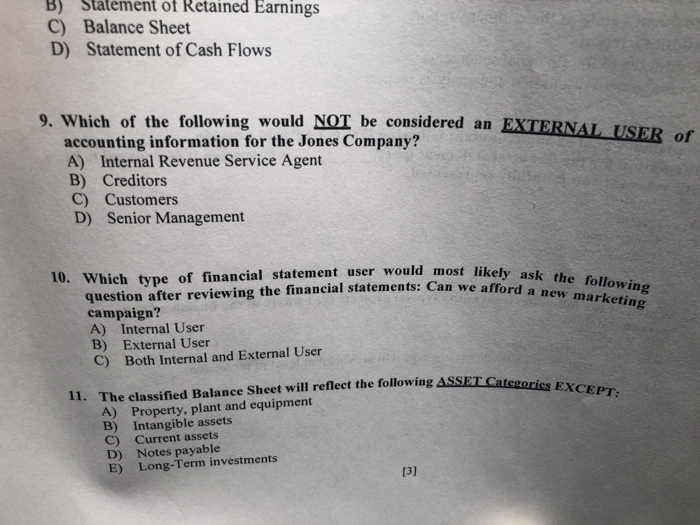

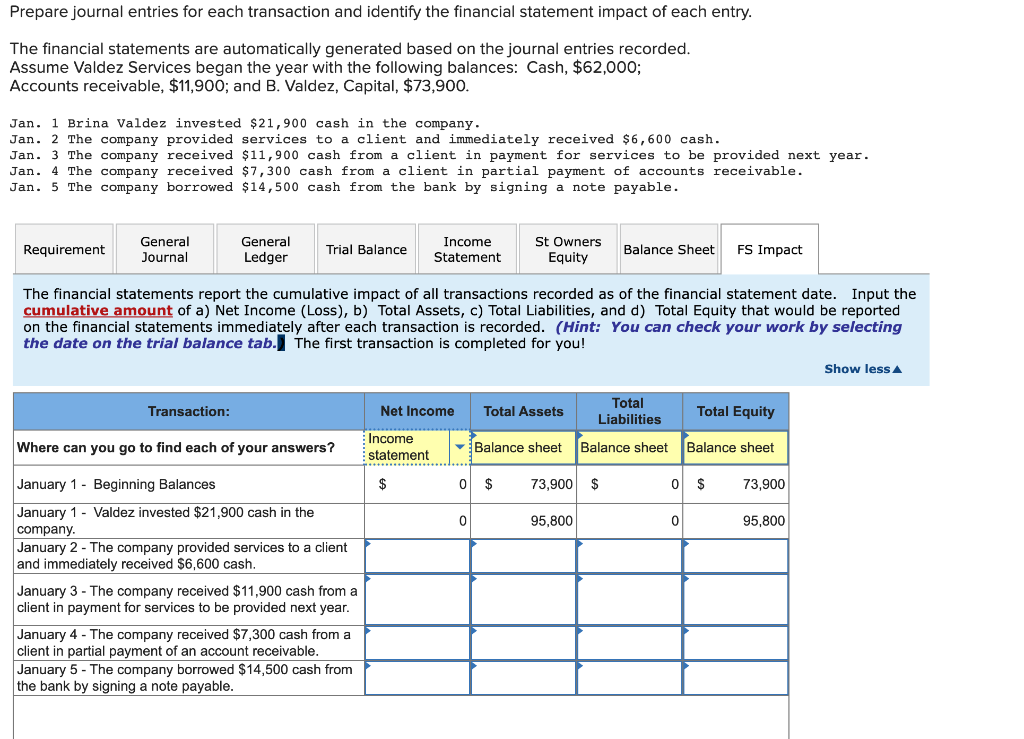

Credit: www.chegg.com

Types Of Financial Statements

Financial statements are crucial tools that provide a snapshot of a company’s financial performance and position. These statements are essential for stakeholders to make informed decisions. There are three main types of financial statements: Income Statement, Balance Sheet, and Cash Flow Statement. Let’s take a closer look at each one.

Income Statement

The income statement presents the revenues and expenses of a company over a specific period, typically a fiscal quarter or year. It’s also referred to as the profit and loss statement (P&L). The statement showcases the company’s profitability by subtracting expenses from revenues.

Balance Sheet

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It shows the company’s assets, liabilities, and equity, providing an overview of what the company owns and owes. The balance sheet adheres to the accounting equation: Assets = Liabilities + Equity.

Cash Flow Statement

The cash flow statement details the cash and cash equivalents entering and leaving a company. It is divided into three sections: operating activities, investing activities, and financing activities. The cash flow statement provides insights into a company’s liquidity and solvency.

Generating Financial Statements

Generating financial statements is an essential aspect of business management and accounting. As businesses produce various transactions, it becomes crucial to compile these records into organized, comprehensive financial statements. Whether using accounting software or manual methods, the process of generating financial statements is vital for tracking a company’s financial health and making informed decisions.

Accounting Software

Accounting software plays a pivotal role in automating and streamlining the generation of financial statements. Utilizing dedicated accounting software such as QuickBooks or Xero enables businesses to efficiently compile income statements, balance sheets, and cash flow statements. These programs facilitate the systematic organization of financial data, simplifying the process of creating accurate and detailed reports.

Manual Methods

Manual methods of generating financial statements involve the use of spreadsheets, ledgers, and other traditional accounting tools. While this approach may be more labor-intensive, it offers greater flexibility and customization. By manually inputting financial data into predefined templates, businesses can tailor their reports to specific needs and requirements.

Data Sources For Financial Statements

When it comes to generating financial statements, businesses rely on various data sources to compile accurate and comprehensive reports. These sources provide the necessary information to analyze the financial health of a company and make informed business decisions. One key aspect of financial statement generation is the utilization of different data sources, including internal records and bank statements.

Internal Records

Internal records refer to the detailed financial information that a company maintains within its own systems. These records include transactional data, such as sales invoices, purchase orders, payroll records, and general ledger entries. By accurately recording these internal transactions, businesses can extract the necessary data to construct financial statements.

Moreover, internal records also encompass financial reports, such as income statements, balance sheets, and cash flow statements. These reports summarize the company’s financial performance and provide essential insights into its overall financial position.

Bank Statements

Bank statements play a crucial role in generating financial statements as they provide an external view of a company’s financial activities. Bank statements include detailed information about the company’s deposits, withdrawals, and other transactions conducted through its bank accounts.

By examining bank statements, businesses can track their cash inflows and outflows, identify any discrepancies, and reconcile their financial records. This data is essential for accurately reflecting the company’s cash position and ensuring the accuracy of its financial statements.

Furthermore, bank statements also provide valuable information for reconciling other financial accounts, such as accounts receivable and accounts payable. By comparing bank transactions with internal records, businesses can identify any discrepancies and ensure the integrity of their financial data.

To summarize, financial statements can be generated from various data sources, including internal records and bank statements. Internal records provide a detailed view of a company’s financial transactions and reports, while bank statements offer an external perspective on its cash flow and financial activities. By leveraging these data sources, businesses can compile accurate and reliable financial statements, which serve as essential tools for decision-making and assessing the overall financial health of the company.

Components Of Financial Statements

Assets

Assets are what a company owns, including cash, investments, and property.

Liabilities

Liabilities represent what a company owes, such as loans and accounts payable.

Equity

Equity is the difference between assets and liabilities, showing the company’s net worth.

Analyzing Financial Statements

The analysis of Financial Statements is crucial for gaining insights into a company’s financial health. Properly Analyzing Financial Statements involves looking at Ratios and Trends Analysis.

Ratios

Key financial indicators that provide valuable information about a company’s performance.

- Liquidity Ratios

- Profitability Ratios

- Efficiency Ratios

Trends Analysis

Examining patterns over multiple periods to identify growth or decline.

- Revenue Trends

- Expense Trends

- Profit Trends

Utilizing Financial Statements

When it comes to managing your finances, understanding and utilizing financial statements is crucial. Financial statements are comprehensive reports that provide valuable insights into a company’s financial performance. They can be generated from various sources, including:

Investor Relations

Financial statements play a significant role in investor relations. Investors, both current and potential, rely on these statements to evaluate the financial health and stability of a company. By analyzing financial statements such as the balance sheet, income statement, and statement of cash flows, investors can make informed decisions about buying, selling, or holding onto their shares.

Financial Planning

Financial statements are vital tools for financial planning. They provide an overview of a company’s assets, liabilities, revenue, and expenses, allowing businesses to forecast future cash flows and make strategic decisions. Whether it’s budgeting, setting financial goals, or tracking progress, financial statements are essential in ensuring effective financial planning.

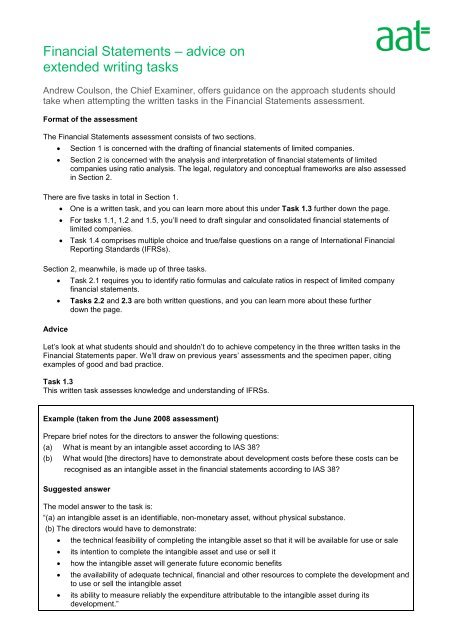

Credit: www.yumpu.com

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)

Credit: www.investopedia.com

Frequently Asked Questions For Financial Statements Can Be Generated From Which Of The Following

What Are The Financial Statements Created From?

Financial statements are generated from a company’s financial data. These statements include the income statement, balance sheet, and cash flow statement. They provide a clear overview of the company’s performance and financial position.

How Do You Generate Financial Statements?

To generate financial statements, gather all financial data and use accounting software or spreadsheets to organize and analyze it. Then, create the income statement, balance sheet, and cash flow statement based on the compiled data. Review and verify the statements for accuracy before finalizing.

What Are The Main Sources Of Financial Statements?

The main sources of financial statements are a company’s accounting records, including income statements, balance sheets, and cash flow statements. These documents provide a detailed overview of a company’s financial performance, position, and cash flows.

What Are The 4 Financial Statements?

The four financial statements are: the income statement, balance sheet, cash flow statement, and statement of changes in equity.

What Are The Key Components Of Financial Statements?

Financial statements typically include balance sheets, income statements, and cash flow statements.

Conclusion

Financial statements can be generated from a variety of sources, including income statements, balance sheets, and cash flow statements. These statements provide valuable insights into a company’s financial health and are crucial for decision-making and analysis. By accurately preparing and interpreting these statements, businesses can effectively manage their finances and plan for the future.

Understanding the generation process of financial statements is essential for individuals and organizations seeking to make informed financial decisions.