Private companies have various financing alternatives, including equity financing, debt financing, and alternative sources such as crowdfunding and venture capital. These options allow private companies to access the capital needed for growth and expansion, while also maintaining control over their business operations and decision-making processes.

In today’s highly competitive business environment, access to financing is critical for private companies looking to achieve sustainable growth and success. Whether it’s through equity financing, debt financing, or alternative sources such as crowdfunding and venture capital, private companies have a range of options to consider.

Each financing alternative comes with its own set of advantages and considerations, and understanding the implications of each can help private companies make informed decisions about their financial strategies. We’ll explore the various financing alternatives available to private companies and discuss the factors to consider when determining the most suitable option for their unique business needs.

Credit: finance.yahoo.com

Challenges In Private Company Financing

Private companies often face challenges when seeking financing alternatives. From traditional bank loans to venture capital and private equity, the right funding option can be crucial for growth and success. Evaluating the pros and cons of each choice is essential in navigating the complex landscape of private company financing.

Market Volatility

In the realm of private company financing, one challenge that often arises is market volatility. Companies may experience significant fluctuations in their revenue, depending on the overall state of the economy, changing consumer preferences, or industry-specific factors. These fluctuations can pose challenges when seeking financing, as lenders and investors may be wary of providing funding to a company that operates in a volatile market.

Lack Of Collateral

Another hurdle that private companies face when seeking financing is the lack of collateral. Collateral is an asset that the borrower pledges to the lender as security for the loan. In many cases, lenders require collateral to minimize their risk in case the borrower defaults. However, private companies often have limited tangible assets that can serve as collateral, as their value primarily lies in intellectual property, brand reputation, or intangible assets that are difficult to quantify.

This lack of collateral makes it challenging for private companies to secure traditional loans from banks or other financial institutions that typically require tangible assets as security.

Traditional Financing Options

For a private company seeking financing alternatives, traditional options like bank loans, lines of credit, or private equity funding provide viable choices. These methods offer reliable and established avenues for securing capital to support business growth and expansion, ensuring flexibility and stability in financial planning.

Traditional Financing Options When a private company seeks funding, there are various traditional financing options available. Bank loans, for instance, are a primary source of capital for many businesses. Another viable option is borrowing from friends and family. Let’s explore these further.Bank Loans

Bank loans are a common way for private companies to access capital. They typically offer competitive interest rates and structured repayment plans. As part of the application process, businesses are required to submit financial statements and business plans to demonstrate their creditworthiness.Friends And Family

Borrowing from friends and family can be an attractive option for private companies. This approach may offer more flexible terms compared to traditional bank loans. However, it’s crucial for both parties to formalize the arrangement with a written agreement to avoid potential misunderstandings. In summary, traditional financing avenues such as bank loans and borrowing from friends and family are viable options for private companies seeking capital infusion. Each option has its benefits and considerations, and businesses should carefully evaluate which option aligns best with their financial needs and long-term goals.Alternative Financing Methods

When a private company is in need of financing, there are several alternative methods they can consider to secure the funding they require. These alternative financing options can provide the capital needed for growth and expansion without the strict requirements and limitations of traditional bank loans.

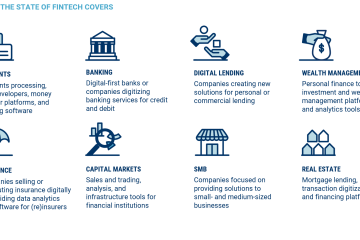

Venture Capital

Venture capital is a form of private equity financing that is provided by firms or funds to small, early-stage, emerging companies that are deemed to have high growth potential or which have demonstrated high growth. Typically, venture capital investments are made in exchange for equity, and they can also offer strategic guidance and management expertise to help the company succeed.

Angel Investors

Angel investors are individuals who provide financial backing for small startups or entrepreneurs, typically in exchange for ownership equity in the company. These investors often provide not only capital but also valuable advice, industry contacts, and mentorship to the companies they invest in. They are an attractive financing option for companies that may not be ready for venture capital funding.

Crowdfunding

Crowdfunding is a method of raising capital through the collective effort of friends, family, customers, and individual investors. It allows entrepreneurs to fund their projects or ventures by raising small amounts of money from a large number of people, typically via online platforms and social media. Crowdfunding can be an effective way to validate market interest and generate early revenue for a private company.

Debt Financing Vs. Equity Financing

When it comes to financing options for a private company, two primary choices stand out: debt financing and equity financing. Both methods have their pros and cons, offering different risk and reward dynamics. In this section, we will explore these two financing alternatives in detail.

Pros And Cons

Debt Financing:

Debt financing involves borrowing money from external sources, such as banks or financial institutions, that must be paid back over a specified period with interest. Here are some of the pros and cons of debt financing:

| Pros | Cons |

|---|---|

|

|

Equity Financing:

Equity financing involves selling a portion of ownership in a company in exchange for capital. Here are some of the pros and cons of equity financing:

| Pros | Cons |

|---|---|

|

|

Risk And Reward

Both debt financing and equity financing carry their unique risk and reward profiles. Here is a breakdown of the risk and reward dynamics associated with each method:

- Debt Financing:

- Low risk as repayments are contractual and predictable.

- Interest payments increase the overall cost of capital.

- Equity Financing:

- Higher risk as investors expect a return on their investment.

- Potential for substantial rewards if the company succeeds and grows.

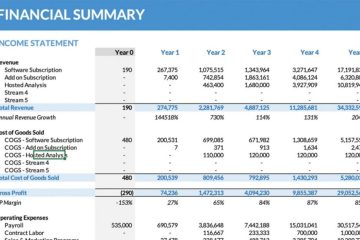

Impact Of Financial Performance

Understanding the Impact of Financial Performance is crucial for private companies seeking financing alternatives. Analyzing Profitability and Cash Flow provides valuable insights into a company’s financial stability and growth potential.

Profitability

- Profitability measures a company’s ability to generate income relative to its expenses.

- It is a key indicator of financial health and sustainability for potential investors.

- High profitability indicates efficient operations and strong market positioning.

Cash Flow

- Cash flow represents the movement of money in and out of a business.

- Positive cash flow ensures liquidity for operational needs and future investments.

- Stable cash flow is essential for meeting financial obligations and maintaining business continuity.

:max_bytes(150000):strip_icc()/Enterprisevalue-f187d033e3284b8397489a4b7825848b.jpg)

Credit: www.investopedia.com

Regulatory Considerations

Regulatory considerations play a crucial role in the financing alternatives available to private companies. Understanding SEC Compliance and Tax Implications is essential for navigating the complex regulatory landscape.

Sec Compliance

Private companies that opt for financing alternatives must comply with a range of regulations set by the Securities and Exchange Commission (SEC). This involves adhering to disclosure requirements and reporting obligations.

Tax Implications

Assessing the tax implications of different financing options is vital for private companies. Tax considerations impact the overall cost of capital and financial performance.

Choosing The Right Financing Option

When it comes to financing alternatives for a private company, choosing the right option can be a critical decision. The right financing can provide the necessary capital to support growth and expansion, while the wrong choice can result in unnecessary costs and restrictions.

Company Stage

One important factor to consider when selecting a financing option is the stage of your company. Whether you are a startup, early-stage company, or an established business, the appropriate financing option may differ based on your specific needs and goals.

For startups, who are often in the initial stages of development, equity financing may be an attractive option. This involves selling shares of the company to investors in exchange for capital. Equity financing provides the necessary funds without adding additional debt to the company’s balance sheet. This can be particularly beneficial for companies that do not have a proven track record or significant assets to secure a loan.

Early-stage companies that have established some market presence but still require significant funding for growth may consider a combination of equity financing and debt financing. Debt financing involves taking on loans or lines of credit to finance operations or specific projects. It is important to carefully evaluate the terms and interest rates associated with debt financing to ensure it aligns with the company’s financial capabilities.

As a company progresses and becomes more established, alternative financing options such as mezzanine financing or private placements may become viable alternatives. Mezzanine financing typically involves a combination of debt and equity financing and is often used to fund acquisitions or major expansions. Private placements involve selling securities directly to accredited investors and can provide more flexibility and control compared to traditional equity financing.

Long-term Goals

Another crucial consideration when choosing a financing option for your private company is your long-term goals. Understanding your company’s growth trajectory and expansion plans can help guide the decision-making process.

If your goal is to rapidly scale your business and achieve significant market share, equity financing may be the preferred option. This can provide the necessary capital injection to support aggressive growth strategies, such as expanding into new markets or acquiring competitors.

On the other hand, if your focus is on long-term sustainability and profitability, debt financing may be a better fit. With debt financing, you maintain ownership and control of your company while leveraging borrowed funds to support operations and growth. This option can be particularly attractive for companies with stable cash flows and reliable revenue streams.

Ultimately, the right financing option for your private company will depend on a careful evaluation of your company’s stage, long-term goals, financial capabilities, and risk appetite. It is important to seek expert advice and conduct thorough due diligence before making a decision to secure the best financing option to support your company’s success.

Credit: www.linkedin.com

Frequently Asked Questions Of Financing Alternatives For A Private Company

How Are Private Companies Financed?

Private companies are financed through various methods like equity financing, borrowing from banks or other lenders, and attracting investment through venture capitalists or angel investors. They may also generate funds through retained earnings or crowdfunding platforms.

What Is The Cheapest Way For A Company To Finance Itself?

The cheapest way for a company to finance itself is through bootstrapping or self-funding. This involves using personal savings, revenue reinvestment, or obtaining a loan from friends/family.

What Is The Cheapest Source Of Financing For A Company?

Equity financing is often the cheapest source of financing for a company. It involves selling shares of the company to investors in exchange for capital.

What Is The Best Financing Option For A Business?

A business’s best financing option depends on factors like its needs, creditworthiness, and risk tolerance. Common options include bank loans, crowdfunding, venture capital, and business lines of credit. Research and compare these options to find the one that suits your particular business requirements.

What Are The Common Financing Options For Private Companies?

Private companies typically access financing through equity investments, venture capital, loans, or crowdfunding.

Conclusion

Considering the various financing alternatives available, private companies have plenty of options to choose from. Whether it’s venture capital, angel investors, loans, or crowdfunding, each avenue has its own benefits and drawbacks. By carefully assessing their specific needs and financial goals, private companies can make informed decisions to secure the most suitable financing option.

Remember, a well-planned financial strategy can lay the foundation for long-term success and growth.