Seller financing can be structured as a land contract or a lease option. This allows the buyer to make payments directly to the seller instead of obtaining a traditional mortgage.

Seller financing offers a flexible alternative for buyers who may not qualify for a conventional loan. It can also benefit sellers by attracting a larger pool of potential buyers and providing a steady income stream. By understanding the different ways seller financing can be structured, both buyers and sellers can explore a mutually beneficial arrangement.

However, it’s essential to carefully consider the terms and risks involved before entering into this type of agreement. We will delve into the various ways seller financing can be structured and the potential advantages and disadvantages for both parties involved.

Types Of Seller Financing

When it comes to real estate transactions, buyers and sellers have various options to consider. One such option is seller financing, which can be structured in different ways depending on the needs and preferences of the parties involved. Understanding the different types of seller financing can help both buyers and sellers make informed decisions. Below, we explore four common types of seller financing: Promissory Note, Land Contract, All-Inclusive Mortgage, and Lease Option.

Promissory Note

A Promissory Note, sometimes known as a seller carry-back mortgage, is a type of seller financing in which the seller acts as the lender and the buyer becomes the borrower. In this arrangement, the seller extends a loan to the buyer, who promises to repay it over a specified period of time. The terms of the Promissory Note typically include the loan amount, interest rate, repayment schedule, and any applicable fees. This type of financing can be a viable option for buyers who may not qualify for traditional bank loans or for sellers who want to earn ongoing interest on the sale proceeds.

Land Contract

A Land Contract, also known as a contract for deed or an installment sale agreement, is another form of seller financing. In a Land Contract, the buyer agrees to make regular payments to the seller over a specific timeframe, while the seller retains legal ownership of the property. Once the buyer fulfills all the payment obligations, the seller transfers the title to the buyer. Land Contracts can be advantageous for buyers who do not have sufficient funds for a down payment or for sellers who prefer a slower transfer of ownership.

All-inclusive Mortgage

An All-Inclusive Mortgage, commonly referred to as a wraparound mortgage or an all-inclusive trust deed, is a type of seller financing where the buyer takes over the existing mortgage from the seller and pays an additional amount to cover the difference between the outstanding loan balance and the purchase price. In this arrangement, the buyer makes a single payment to the seller, who then uses part of that payment to satisfy the underlying mortgage. The buyer gains ownership of the property and assumes responsibility for the existing mortgage, while the seller receives the difference as income. This type of financing can be attractive for buyers seeking flexibility in down payment requirements and sellers looking for a steady income stream.

Lease Option

A Lease Option, also known as a rent-to-own agreement or a lease-purchase agreement, combines elements of a lease and a purchase contract. In a lease option, the buyer rents the property from the seller with the option to purchase it at a predetermined price within a specified period of time. A portion of the monthly rent may be credited towards the purchase price, providing the buyer with an opportunity to accumulate a down payment while leasing the property. This type of financing can be beneficial for buyers who want to test drive a property before committing to a purchase and sellers who are open to offering potential buyers some flexibility.

Credit: www.bankrate.com

Advantages Of Seller Financing

Seller financing can be a beneficial option for both buyers and sellers in a real estate transaction. This alternative financing method offers a range of advantages that make it an attractive option for many parties involved.

Increased Pool Of Buyers

Seller financing can expand the pool of potential buyers for a property, as it provides an opportunity for individuals who may not qualify for traditional mortgage loans to purchase a home. This can lead to a faster sale and a wider range of interested parties.

Flexible Terms

One of the key benefits of seller financing is the flexibility it offers in negotiating terms. Sellers and buyers can work together to create a financing arrangement that suits the needs of both parties, including interest rates, down payments, and repayment schedules.

Faster Closing Process

Compared to traditional mortgage loans, seller financing often leads to a quicker closing process. Since the transaction does not require third-party approval and extensive paperwork, it can streamline the sale and benefit both the buyer and the seller.

Risks And Considerations

Seller financing can be an attractive option for both buyers and sellers, but it comes with its own set of risks and considerations that need to be carefully evaluated. Understanding and mitigating these risks is crucial to making seller financing a successful arrangement for all parties involved.

Credit Risk

Seller financing involves the seller acting as the lender, which means they can be exposed to credit risk. The buyer’s ability to repay the loan is a significant consideration, and sellers need to thoroughly assess the buyer’s creditworthiness before agreeing to the financing terms. Conducting a thorough credit check and evaluating the buyer’s financial stability is essential to mitigate the potential credit risk involved in seller financing.

Down Payment Amount

The down payment amount is another critical factor to be considered in seller financing. A substantial down payment from the buyer can provide a buffer for the seller against potential defaults. Sellers should carefully determine the appropriate down payment percentage to minimize their risk exposure and ensure the buyer’s commitment to the property purchase.

Interest Rates

The interest rates in seller financing arrangements need to be carefully structured to balance the seller’s return on investment with the buyer’s affordability. Setting an appropriate interest rate is vital to the success of the transaction, as excessively high rates could burden the buyer, leading to potential default, while very low rates may not adequately compensate the seller for the risk taken. Both parties need to agree on a fair and competitive interest rate that aligns with the current market conditions.

Negotiating Seller Financing

Seller financing can be structured as a valuable option for negotiating terms. Offering flexible repayment schedules and interest rates, sellers can help buyers secure funding without traditional lenders. This arrangement benefits both parties by facilitating the purchase of a property through customized financing solutions.

Seller financing offers a unique opportunity for buyers to secure funding directly from the seller instead of relying on traditional lenders. However, negotiating the terms of seller financing requires finding common ground and protecting the interests of both parties involved. By understanding the key considerations and strategies involved in negotiating seller financing, buyers and sellers can ensure a smooth and mutually beneficial transaction.

Finding Common Ground

When it comes to negotiating seller financing, finding common ground is essential for both buyers and sellers. Here are a few key areas where agreement needs to be reached:

- The purchase price: Both parties should agree on a fair purchase price that reflects the value of the property being sold.

- Down payment: Sellers may require a down payment to secure the financing. Negotiating an amount that is agreeable to both parties is crucial.

- Interest rate: The interest rate on the seller financing can significantly impact the buyer’s costs and the seller’s return. A fair interest rate should be determined through negotiation.

- Repayment terms: Negotiating the terms of repayment, including the duration of the financing and the frequency of payments, is important to ensure both parties’ satisfaction.

Protecting Both Parties

Protecting the interests of both parties is paramount when negotiating seller financing. Here are a few steps that can be taken to ensure a fair and secure agreement:

- Documentation: It is essential to document the terms of the seller financing in a legally binding agreement to protect both parties’ rights and obligations.

- Title search and insurance: Conducting a title search and obtaining title insurance can provide peace of mind to both parties, ensuring that the property being sold has a clean title.

- Lien release: Sellers should request a lien release from the buyer upon repayment of the seller financing to protect against any potential future claims on the property.

- Default provisions: Including provisions that outline the consequences of default, such as late payment penalties or the seller’s right to foreclose, can protect the seller’s interests in case of buyer default.

By negotiating seller financing with the goal of finding common ground and protecting the interests of both parties, buyers and sellers can establish a solid foundation for a successful transaction. Clear and transparent communication throughout the negotiation process is key to achieving a mutually beneficial agreement.

Legal Aspects

When engaging in seller financing, it’s crucial to consider the legal aspects to ensure a smooth transaction and compliance with regulations.

Documentation Requirements:

- Sale Agreement: A comprehensive contract outlining terms and conditions.

- Promissory Note: Documenting the buyer’s promise to pay the seller.

- Deed of Trust: Providing security for the loan through the property.

Compliance With Regulations:

- Truth in Lending Act: Ensures transparent communication of loan terms.

- Usury Laws: Regulations on interest rates to prevent predatory lending.

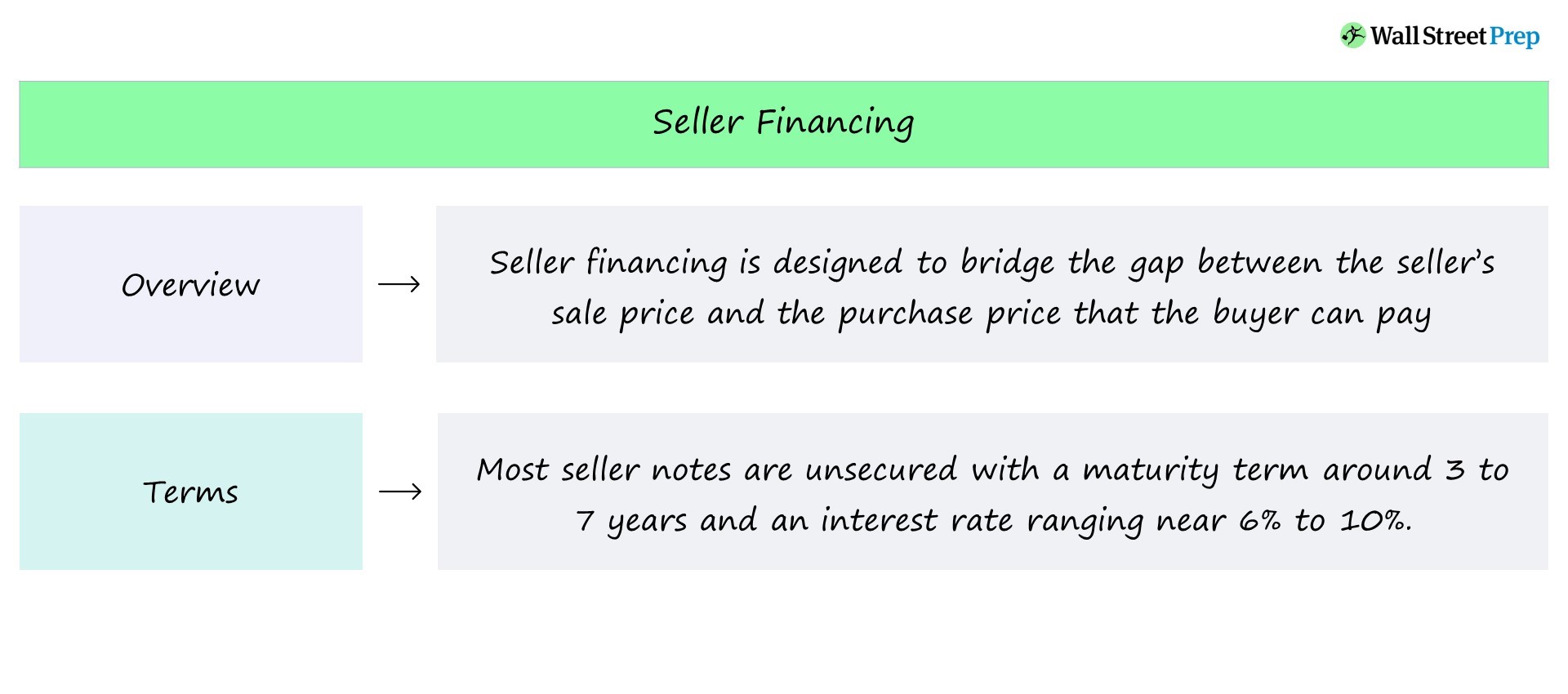

Credit: www.wallstreetprep.com

Credit: corporatefinanceinstitute.com

Frequently Asked Questions Of Seller Financing Can Be Structured As A

What Is Seller Financing Also Known As?

Seller financing is also known as owner financing, and it allows buyers to purchase a property directly from the seller. The seller acts as the lender, providing a loan to the buyer, who makes payments to the seller instead of a traditional mortgage lender.

What Is The Structure Of A Seller Note?

A seller note typically has a basic structure, including the terms of the loan, interest rate, repayment schedule, and any collateral. It may also outline buyer and seller responsibilities. The note is tailored to the agreement between the parties.

How Does Seller Financing Work In M&a?

Seller financing in M&A involves the seller providing a loan to the buyer for part of the purchase price. The buyer then pays back the loan over time, along with interest. This can help bridge the gap between the buyer’s available funds and the purchase price, making the deal more feasible.

How Does Seller Financing Work In A Business Sale?

Seller financing in a business sale involves the seller providing funds to the buyer for the purchase. The buyer makes regular payments to the seller, including interest, over a predetermined period. This arrangement allows buyers without adequate funds to acquire the business and provides sellers with additional income.

What Are The Benefits Of Seller Financing?

Seller financing gives buyers flexibility and can help secure funding easier.

Conclusion

Seller financing can be structured in various ways, depending on the needs of both the buyer and the seller. From lease options to land contracts, these methods offer flexible alternatives to traditional mortgage loans. By exploring the possibilities, sellers and buyers can find an arrangement that suits their unique circumstances.

This allows for increased affordability and easier financing, making it a viable option worth considering in today’s real estate market.