Financial decision making involves analyzing, evaluating, and selecting the best investment and financing options for a business. Key aspects include risk assessment, cost-benefit analysis, and financial forecasting to ensure optimal use of resources and achieving the company’s goals.

Financial decision making is a critical process for any organization, as it directly impacts its profitability and long-term sustainability. By carefully considering factors such as risk, return on investment, and available financial resources, businesses can make sound decisions that enhance their financial health and support future growth.

In today’s dynamic and competitive business environment, strategic financial decision making is essential for navigating uncertainties and seizing opportunities to maintain a strong and resilient financial position. This article will explore the key aspects of financial decision making and their significance in achieving sustainable business success.

Importance Of Financial Decision Making

Financial decision making is a critical function within every organization. It involves analyzing and determining the most effective use of financial resources to achieve strategic goals. By making informed decisions, businesses can optimize their financial performance and seize growth opportunities. Let’s explore the importance of financial decision making and its impact on organizational success and long-term growth.

Impact On Organizational Success

Financial decision making plays a crucial role in determining the success of an organization. It directly affects key business aspects such as profitability, liquidity, and solvency. Here’s how:

- Profitability: Effective financial decisions help maximize profits by identifying opportunities for cost reduction and revenue generation.

- Liquidity: By making well-informed decisions, companies ensure they have enough cash flow to meet their short-term obligations.

- Solvency: Financial decision making aids in maintaining a healthy balance sheet and managing debt to sustain the long-term viability of the organization.

Ultimately, the impact of financial decisions on organizational success cannot be overstated. Sound decision making enables companies to stay competitive, adapt to changing market conditions, attract investors, and create value for stakeholders.

Role In Long-term Growth

Financial decision making is not solely focused on short-term gains. It also plays a pivotal role in shaping the long-term growth trajectory of an organization. Here’s how:

- Capital Investment: Effective financial decision making helps businesses identify and evaluate investment opportunities that align with their growth strategies, ensuring optimal use of financial resources.

- Risk Management: By analyzing and assessing the risks associated with different investment options, financial decision making guides organizations in making prudent choices, mitigating potential losses, and safeguarding long-term growth.

- Strategic Planning: Financial decisions inform strategic planning by providing insights into the financial implications of different courses of action. This allows organizations to make informed decisions that support their long-term goals.

By considering the long-term impact of financial decisions, businesses can position themselves for sustained growth, competitive advantage, and increased shareholder value. It is a strategic pillar that drives the organization forward.

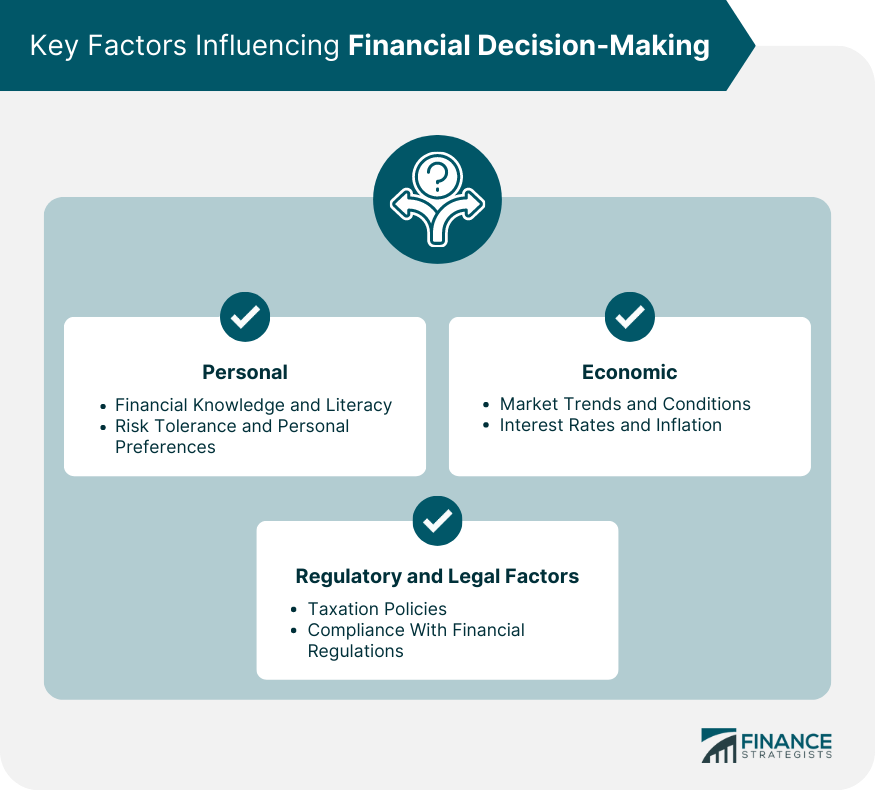

Factors Influencing Financial Decision Making

Financial decision making involves a complex process influenced by various factors. Understanding the key aspects that underpin these decisions is crucial for individuals and businesses. Examining the factors that influence financial decision making — such as market conditions, regulatory environment, and internal resources — helps in gaining better insight into this critical area of finance.

Market Conditions

Market conditions play an essential role in financial decision making. The state of the economy, including factors such as inflation, interest rates, and overall market volatility, directly impacts the decisions made by individuals and organizations. Fluctuations in the stock market, changes in consumer behavior, and global economic trends can significantly affect financial decisions.

Regulatory Environment

The regulatory environment also holds significant influence over financial decision making. Laws, regulations, and policies set by government bodies and regulatory authorities impact how financial decisions are made and the options available to individuals and businesses. Compliance with financial regulations and staying abreast of legal requirements is essential for making sound financial decisions.

Internal Resources

Internal resources, such as the financial capabilities, operational capacity, and expertise within an organization, are critical factors in financial decision making. Assessing the available resources, evaluating the financial health of the company, and understanding its risk tolerance are vital in making prudent financial decisions. Utilizing internal resources effectively can lead to better financial outcomes.

Risk Assessment In Financial Decision Making

Risk assessment is a critical aspect of financial decision making. It involves evaluating potential risks and uncertainties associated with different courses of action. Effective risk assessment in financial decision making enables individuals and organizations to make informed choices that align with their objectives and risk appetite.

Risk Identification

Identifying risks is the first step in the risk assessment process. It involves recognizing potential events or circumstances that could have adverse effects on financial goals and outcomes. By being proactive in identifying risks, individuals and businesses can anticipate potential challenges and take proactive measures to address them. This can involve various factors such as market fluctuations, credit risks, operational issues, and regulatory changes.

Risk Mitigation Strategies

Once risks are identified, the focus shifts to developing strategies to mitigate their impact. This involves implementing specific measures to minimize the likelihood of negative outcomes. Utilizing diversification, hedging, insurance, and setting aside contingency funds are examples of risk mitigation strategies in financial decision making. By proactively implementing these strategies, individuals and organizations can safeguard their financial interests and reduce the impact of unforeseen events.

:max_bytes(150000):strip_icc()/FinancialLiteracy_Final_4196456-74c34377122d43748ed63ef46a285116.jpg)

Credit: www.investopedia.com

Tools For Financial Decision Making

Financial decision making involves using various tools to analyze and assess different aspects of the financial landscape. Key aspects include risk assessment, cost-benefit analysis, forecasting, and financial modeling. These tools aid in evaluating potential outcomes and making informed decisions to maximize financial success.

Financial decision making is a crucial aspect of managing personal or business finances. To make informed decisions, individuals and organizations rely on various tools that provide valuable insights and assist in evaluating financial situations. Some key tools for financial decision making include financial ratios, budgeting techniques, and financial forecasting.Financial Ratios

Financial ratios are essential tools that help assess the financial health and performance of an individual or an organization. These ratios provide a snapshot of key financial aspects by comparing different variables within financial statements. Commonly used financial ratios include:- Liquidity ratios – measure the ability to meet short-term obligations.

- Profitability ratios – gauge the profitability of a business.

- Solvency ratios – assess the long-term financial stability and debt repayment capability.

- Efficiency ratios – evaluate how effectively resources are utilized.

Budgeting Techniques

Budgeting techniques play a pivotal role in financial decision making. A budget is a detailed plan that outlines income, expenses, and savings over a specific period. It provides a framework for managing finances and helps individuals prioritize spending, control costs, and achieve financial goals. Common budgeting techniques include:- Zero-based budgeting – every expense must be justified and planned from scratch.

- Incremental budgeting – previous budgets serve as a baseline, with adjustments made for changes in income and expenses.

- Envelope budgeting – cash is divided into envelopes, each representing a different expense category.

- Activity-based budgeting – focuses on specific activities or projects, assigning resources accordingly.

Financial Forecasting

Financial forecasting is a tool that enables individuals and organizations to project future financial outcomes based on historical data and market trends. By analyzing past financial performance, industry trends, and economic indicators, financial forecasting helps individuals and businesses make informed predictions about cash flow, revenue, and expenses. Forecasting techniques may include:- Qualitative forecasting – leveraging expert opinions and market research to make predictions.

- Quantitative forecasting – utilizing mathematical models and historical data to forecast future financial outcomes.

- Scenario analysis – examining various scenarios to understand potential impacts on financial outcomes.

Ethical Considerations In Financial Decision Making

Financial decision making is crucial in business, but ethical considerations play a vital role in these decisions.

Transparency

In financial decision making, transparency is essential to build trust with stakeholders.

Accountability

Accountability ensures that individuals are responsible for their decisions and actions.

Technology’s Impact On Financial Decision Making

Technology continues to shape the landscape of financial decision making, offering new possibilities and efficiencies in the way decisions are made.

Automation Of Processes

In the realm of financial decision making, automation of processes plays a critical role in streamlining operations and reducing human errors.

Access To Real-time Data

Having access to real-time data empowers decision-makers to act swiftly and confidently based on the most up-to-date information available.

Future Trends In Financial Decision Making

The future of financial decision making is rapidly evolving with the integration of artificial intelligence and predictive analytics. These innovative technologies are revolutionizing the way businesses approach and make important financial decisions.

Artificial Intelligence Integration

Artificial intelligence (AI) integration is reshaping the financial decision-making landscape. By utilizing advanced algorithms and machine learning capabilities, AI systems can analyze massive amounts of data and provide valuable insights to assist in financial decision making. Whether it’s predicting market trends, optimizing investment portfolios or assessing risks, AI technology offers businesses a powerful tool to augment human decision-making capabilities.

AI-powered algorithms can process vast amounts of data in real time, enabling organizations to make informed decisions quickly. These algorithms can also identify patterns and trends that may not be noticeable to human analysts, allowing businesses to seize opportunities and mitigate potential risks. With AI integration, financial decision making becomes more efficient, accurate, and data-driven.

Predictive Analytics

Predictive analytics is another crucial aspect of future financial decision making. By leveraging historical and real-time data, organizations can forecast future trends, enabling them to make well-informed decisions and create effective strategies. Predictive analytics algorithms can analyze numerous variables and identify relationships between them, providing insights into key drivers and potential outcomes.

With predictive analytics, businesses can anticipate market shifts, customer behavior changes, and emerging trends. By knowing what’s likely to happen, organizations can align their financial decisions accordingly, reducing uncertainties and maximizing opportunities. This proactive approach empowers businesses to gain a competitive edge.

Moreover, predictive analytics helps in optimizing business operations. By analyzing various factors such as resource allocation, demand forecasting, and cost management, organizations can make data-driven decisions to improve efficiency, minimize waste, and enhance profitability.

Overall, the future of financial decision making lies in the integration of artificial intelligence and predictive analytics. By harnessing the power of these technologies, businesses can enhance their decision-making processes, seize opportunities, mitigate risks, and achieve sustainable growth.

Credit: www.boldreports.com

Credit: www.financestrategists.com

Frequently Asked Questions For What Are The Key Aspects Of Financial Decision Making

What Is The Financial Aspect Of Decision Making?

Financial aspect of decision making involves evaluating costs, benefits, and risks to make sound choices. It requires analyzing financial data and considering potential outcomes to ensure effective resource allocation. This process aids in achieving strategic goals and maximizing profitability.

What Is A Key Factor In Making Financial Decisions?

One key factor in financial decision-making is careful consideration of available information. By analyzing relevant data and evaluating risks and rewards, individuals can make informed choices that align with their goals and financial circumstances.

What Are The Key Financial Decisions?

Key financial decisions include budgeting, investing, saving for retirement, managing debt, and planning for major purchases.

What Are The 4 Main Factors That Affect Your Financial Decision Making?

The 4 main factors that affect financial decision making are income level, expenses, goals, and risk tolerance.

How Do Emotions Affect Financial Decision Making?

Emotions can cloud judgment, leading to impulsive decisions. It’s important to remain rational and logical.

Conclusion

Effective financial decision-making involves considering various key aspects such as identifying goals, analyzing risks, evaluating options, and understanding the financial landscape. By employing a thoughtful decision-making process, individuals and businesses can optimize their financial outcomes and secure their future. Stay informed, stay focused, and make informed decisions to achieve long-term financial success.