The main features of the financial system in India include a variety of institutions, such as commercial banks, capital markets, and insurances, that facilitate the allocation of funds and investments. These institutions also provide various financial services like credit, insurance, and payment mechanisms, contributing to the overall economic growth of the country.

India’s financial system is a critical component of its economy, as it plays a vital role in mobilizing savings, ensuring efficient allocation of resources, and promoting overall economic development. The system encompasses a wide array of financial institutions, including commercial and cooperative banks, non-banking financial institutions, and capital markets.

Additionally, regulatory bodies like the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) contribute to the stability and regulation of the financial system. Overall, the financial system in India is instrumental in fostering growth, investment, and financial inclusion in the country.

:max_bytes(150000):strip_icc()/financial-system_final-a9f735f765244e84829563e8a147abf2.jpg)

Credit: www.investopedia.com

Importance Of Financial System In India

India’s financial system is a crucial component of its overall economic framework, playing a vital role in promoting economic growth and facilitating capital formation. The financial system in India is designed to provide a robust infrastructure that ensures the smooth flow of funds and resources within the economy. It consists of various institutions, markets, and intermediaries that work together to mobilize savings, allocate capital, and facilitate financial transactions.

Promotes Economic Growth

A well-functioning financial system is essential for the sustained economic growth of any country, and India is no exception. The financial system in India acts as a catalyst in driving economic development by providing a platform for efficient allocation of financial resources among different sectors. It facilitates the transfer of funds from surplus units to deficit units, enabling businesses to access the necessary capital for expansion and growth.

The financial system also plays a crucial role in promoting entrepreneurship and innovation by providing a supportive ecosystem for both large corporations and small and medium enterprises (SMEs). It provides access to various financing options, such as bank loans, venture capital, and equity markets, which helps businesses to fund their operations, invest in research and development, and bring new products and services to the market. This, in turn, stimulates economic activity, creates employment opportunities, and drives overall economic growth.

Facilitates Capital Formation

Capital formation is a fundamental factor in driving economic growth, and the financial system in India plays a pivotal role in this process. It acts as a bridge between savers and investors, facilitating the efficient allocation of savings into productive investments. The financial system offers a wide range of investment avenues to individuals and institutions, allowing them to channel their savings into productive activities.

Through various financial intermediaries like banks, non-banking financial companies (NBFCs), and mutual funds, the financial system provides a platform for individuals to invest their savings in a diversified portfolio of assets. It offers investment instruments such as fixed deposits, mutual funds, stocks, bonds, and insurance products, allowing individuals to participate in the capital market and earn returns on their investments.

Moreover, the financial system in India plays a critical role in attracting foreign capital and promoting foreign direct investment (FDI). It provides a transparent and well-regulated framework that ensures the safety and security of foreign investors’ funds. This, in turn, contributes to the overall capital formation in the country, boosts economic growth, and enhances India’s position as a favorable investment destination.

Key Components Of The Indian Financial System

Financial system plays a crucial role in the economic development of a country. In India, the financial system consists of various components that collectively contribute to the overall growth and stability of the economy. Understanding the key components of the Indian financial system, including the banking sector, capital markets, and insurance sector, provides insight into the functioning and structure of the country’s financial framework.

Banking Sector

The banking sector in India is a vital part of the country’s financial system. It comprises of various types of banking institutions such as commercial banks, cooperative banks, and regional rural banks. These institutions play a pivotal role in mobilizing savings and providing credit facilities to different segments of the economy. The Reserve Bank of India (RBI) serves as the apex regulatory authority governing the functioning of banks in the country.

Capital Markets

The capital markets in India provide a platform for buying and selling of long-term financial instruments such as stocks, bonds, and derivatives. The Securities and Exchange Board of India (SEBI) regulates and supervises the capital markets to maintain fair and transparent dealings. The capital markets contribute to the efficient allocation of financial resources and facilitate corporate growth and expansion through avenues like equity and debt financing.

Insurance Sector

The insurance sector in India has witnessed significant growth and diversification in recent years. It encompasses life insurance, general insurance, and reinsurance companies, offering a wide range of risk mitigation products to individuals and businesses. The Insurance Regulatory and Development Authority of India (IRDAI) oversees the functioning and development of the insurance sector, ensuring consumer protection and industry stability.

Regulatory Framework

Regulatory framework in the Indian financial system plays a pivotal role in ensuring stability, transparency, and fair practices. The regulatory framework encompasses various institutions and bodies that oversee and regulate different aspects of the financial system.

Role Of Reserve Bank Of India (rbi)

The Reserve Bank of India (RBI) serves as the central bank and the primary regulatory authority for the country’s monetary and financial system. It formulates and implements monetary policies, regulates the functioning of banks and financial institutions, and safeguards the stability of the financial sector.

Securities And Exchange Board Of India (sebi)

SEBI is entrusted with the task of regulating and supervising the securities market in India. It aims to protect the interests of investors, promote the development of the securities market, and regulate the activities of intermediaries and other entities involved in securities trading.

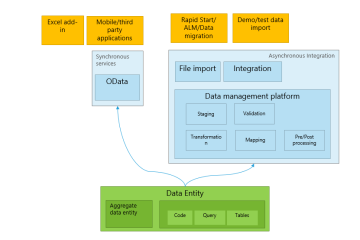

Credit: www.slideshare.net

Financial Inclusion Initiatives

Financial inclusion initiatives in India have played a crucial role in bringing banking services to the unbanked and marginalized sections of society. These initiatives have aimed to provide affordable and accessible financial services to all individuals, irrespective of their income level or geographic location. The government and various financial institutions have implemented several measures to promote financial inclusion, such as the Pradhan Mantri Jan Dhan Yojana and the support for microfinance institutions.

Pradhan Mantri Jan Dhan Yojana

The Pradhan Mantri Jan Dhan Yojana (PMJDY) is a landmark initiative launched by the government of India to ensure financial inclusion for all. This scheme focuses on providing access to banking facilities such as savings accounts, credit facilities, insurance, and pension schemes to the unbanked population.

The key features of the Pradhan Mantri Jan Dhan Yojana include:

- No minimum balance requirements: Individuals can open a Jan Dhan account with zero balance, ensuring financial accessibility for all.

- RuPay debit card: Account holders receive a RuPay debit card, enabling them to make cashless transactions and withdraw money from ATMs.

- Insurance coverage: Account holders are entitled to life insurance and accident insurance coverage.

- Direct Benefit Transfer (DBT): The PMJDY facilitates the transfer of government subsidies and benefits directly to the bank accounts of beneficiaries, eliminating intermediaries and ensuring timely disbursement.

Microfinance Institutions

Microfinance institutions have played a crucial role in promoting financial inclusion in India. These institutions provide financial services, such as small loans, savings accounts, and insurance products, to individuals who lack access to traditional banking services.

The main features of microfinance institutions in India are:

- Targeting the unbanked: Microfinance institutions specifically focus on extending financial services to marginalized individuals, including women, small businesses, and rural communities.

- Flexible loan repayment: Microfinance institutions offer flexible repayment options tailored to the borrower’s income and cash flow, enabling them to repay loans without undue financial burden.

- Group lending: Many microfinance institutions encourage group lending, where borrowers form self-help groups and hold each other accountable for loan repayments, fostering a sense of community and financial discipline.

- Financial literacy and capacity-building: Microfinance institutions provide financial literacy training and capacity-building programs to empower borrowers with financial knowledge and skills.

These financial inclusion initiatives, such as the Pradhan Mantri Jan Dhan Yojana and microfinance institutions, have significantly contributed to bringing individuals into the formal financial system in India. By ensuring access to banking services and promoting financial literacy, these initiatives have played a crucial role in empowering the underprivileged sections of society and fostering economic growth.

Technological Advancements In The Financial Sector

Digital Payments

India’s financial system embraces robust digital payment solutions, facilitating convenient transactions.

Blockchain Technology

Implementing blockchain technology, India ensures secure and transparent financial transactions.

Credit: www.youtube.com

Challenges Faced By The Indian Financial System

The Indian financial system faces several challenges that impact its efficiency and effectiveness. These challenges hamper the system’s ability to function optimally and hinder the overall growth of the economy.

Non-performing Assets (npas)

Non-Performing Assets (NPAs) are a major concern for the Indian financial system, characterized by loans where borrowers fail to make payments for a specified period. NPAs decrease banks’ lending capacity, affecting the overall financial stability.

Lack Of Financial Literacy

Lack of Financial Literacy among a significant portion of the population poses a challenge as it leads to a lack of understanding of financial products and services, hindering their ability to make informed decisions. This results in lower savings and investment rates, impacting the financial system.

Future Outlook Of The Financial System In India

The financial system in India is characterized by a diverse range of institutions, including commercial banks, non-banking financial companies, and various regulatory bodies. Additionally, it encompasses various sectors such as capital markets, insurance, and pension funds, contributing to its dynamic and robust nature.

This diversity creates a stable and inclusive environment, fostering growth and innovation within the industry.

Role Of Fintech Companies

The future outlook of the financial system in India is closely tied to the role of fintech companies. With the rapid advancements in technology and the growing popularity of digital transactions, fintech companies have emerged as the driving force behind the transformation of the financial landscape in India. These companies leverage cutting-edge technology, such as artificial intelligence, blockchain, and mobile applications, to provide innovative financial solutions to individuals and businesses alike. By streamlining processes, improving accessibility, and enhancing security, fintech companies are playing a crucial role in revolutionizing how financial services are delivered in India.Impact Of Policy Reforms

Another major factor influencing the future outlook of the financial system in India is the impact of policy reforms. The Indian government has been proactive in implementing measures to promote financial inclusion, enhance regulatory frameworks, and foster innovation in the financial sector. These policy reforms have created a more conducive environment for businesses to operate, attracting both domestic and foreign investments. The introduction of initiatives such as the Goods and Services Tax (GST), the demonetization drive, and the digital payment ecosystem has helped in formalizing the economy, reducing the reliance on cash, and boosting transparency and accountability. In addition to these policies, the government’s push for financial literacy and inclusion has also had a positive impact on the financial system. Efforts to increase financial literacy among individuals and small business owners have empowered them to make informed decisions, access formal credit facilities, and participate in the formal financial system. The implementation of Pradhan Mantri Jan Dhan Yojana (PMJDY) scheme, which provides access to basic banking services to the underprivileged, has been a significant step towards achieving financial inclusion for all. Overall, the future outlook of the financial system in India looks promising, with fintech companies driving innovation and policy reforms shaping the industry. As technology continues to evolve and the digital revolution gains momentum, the financial system is set to become more efficient, accessible, and secure. The integration of technology and policy reforms will pave the way for a modern and inclusive financial system that caters to the diverse needs of the Indian population. Some of the key highlights of the future outlook of the financial system in India include:- Increased adoption of advanced technologies like artificial intelligence and blockchain.

- Expansion of digital payment infrastructure, leading to a cashless economy.

- Growth of e-commerce and m-commerce platforms, enabling seamless transactions.

- Rise of peer-to-peer lending platforms, providing alternate sources of finance.

- Enhanced cybersecurity measures to protect sensitive financial information.

- Greater collaboration between traditional financial institutions and fintech companies.

Frequently Asked Questions For What Are The Main Features Of Financial System In India

What Are The Features Of The Indian Financial System?

The Indian financial system features banks, financial institutions, stock exchanges, and regulatory bodies. It encompasses a diverse range of financial products and services, promoting economic growth and stability. These features contribute to the efficient functioning and development of the Indian economy.

What Are The Characteristics Of Financial Institutions In India?

Financial institutions in India possess several distinctive characteristics. They include a wide range of institutions like banks, non-banking financial companies (NBFCs), insurance companies, and mutual funds. They play a vital role in mobilizing savings, providing loans and credit facilities, promoting investments, and ensuring the smooth functioning of the financial system.

What Is The Objective Of Indian Financial System?

The main objective of the Indian financial system is to facilitate efficient allocation of funds for economic growth.

What Is The Structure Of The Financial Market In India?

The financial market in India consists of various segments like stock market and bond market. It is regulated by SEBI and RBI to ensure transparency and investor protection.

What Are The Key Functions Of India’s Financial System?

India’s financial system facilitates savings, investments, and capital formation for economic growth.

Conclusion

India’s financial system has several key features that play a crucial role in the country’s economic growth. The system is characterized by a diverse range of financial institutions, including banks, insurance companies, and mutual funds, which contribute to the efficient allocation of capital.

Additionally, the development of digital banking and fintech solutions has further enhanced accessibility and convenience for users. With ongoing reforms and increased financial inclusion initiatives, India’s financial system is well-positioned to support the nation’s aspirations for inclusive and sustainable development.