When financial aid is more than tuition, the excess funds are typically refunded to the student. This money can be used for educational expenses such as books, housing, and other living costs.

Understanding how to manage excess financial aid is important for students. When students receive an excess of financial aid, they can use the additional funds to cover other expenses related to their education, such as textbooks, housing, transportation, and other living costs.

However, it’s crucial for students to use the funds responsibly and not overspend, as the money is intended to support their education. Managing excess financial aid effectively can help students avoid financial stress and focus on their studies, leading to a more successful academic experience. We’ll explore the impact of having more financial aid than tuition and provide tips for managing the additional funds wisely.

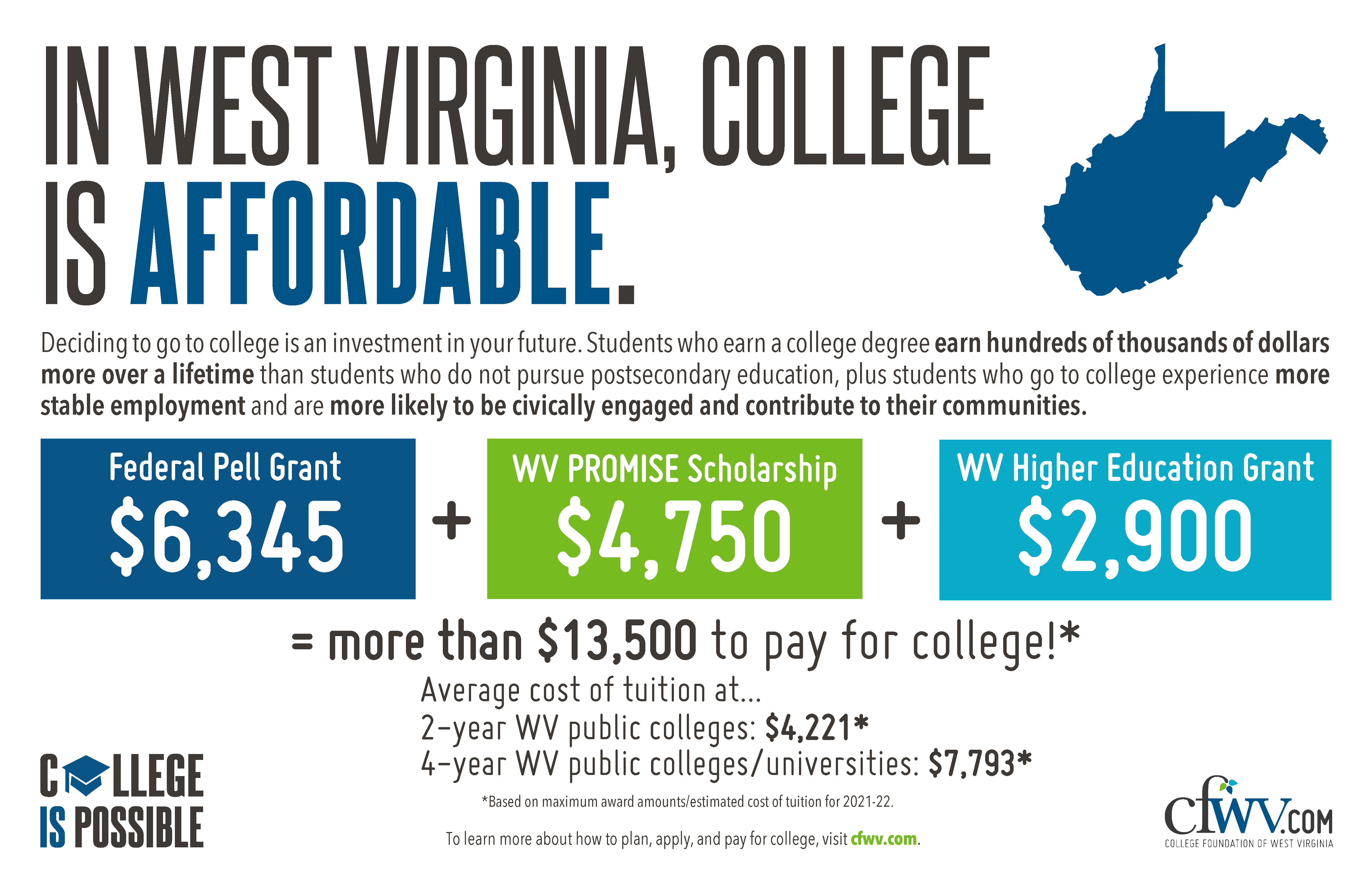

Credit: cfwvconnect.com

Challenges Of Excess Financial Aid

Receiving financial aid that exceeds the cost of tuition may seem like a dream come true for many college students. However, this unexpected surplus can present its own set of challenges that students need to be aware of. From the temptation to increased spending to the potential impact on future financial aid eligibility, it is crucial to understand what happens when financial aid is more than just tuition.

Increased Spending Temptation

When financial aid exceeds tuition, it can be tempting to view the excess as extra money to spend freely. With newfound financial freedom, students might be more inclined to indulge in unnecessary purchases and luxury items. However, it is essential to practice responsible budgeting and avoid the temptation to overspend.

Impact on Financial Aid Eligibility:

The surplus of financial aid can have unexpected consequences on future aid eligibility. If students fail to wisely manage the excess funds and exhaust them quickly, they may face difficulties in covering future educational expenses. This can result in a greater need for financial assistance, potentially affecting eligibility for aid in subsequent academic years.

Impact On Financial Aid Eligibility

Receiving excess financial aid can also impact eligibility for other forms of assistance, such as scholarships or need-based grants. While these additional resources aim to support students with their educational expenses, they are often contingent upon financial need. If the surplus of financial aid pushes the student’s overall financial situation beyond the threshold for need-based assistance, they may no longer qualify for certain grants or scholarships.

FAFSA Considerations:

It is important to note that the Free Application for Federal Student Aid (FAFSA) requires students to report their income and assets accurately. If the excess financial aid creates a significant increase in savings or income, future FAFSA applications may raise red flags, potentially leading to additional scrutiny or adjustments in aid eligibility.

It is crucial for students to remain mindful of these challenges and make informed decisions regarding excess financial aid. Responsible spending, budgeting, and considering the long-term implications are crucial to making the most of this opportunity while maintaining financial stability throughout the college journey.

Options For Excess Financial Aid

Having excess financial aid beyond covering tuition can be a pleasant surprise for many students. But what happens to the extra funds? Thankfully, there are various options for utilizing surplus financial aid that can benefit students in different ways.

Refund Requests

Students who find themselves with excess financial aid after tuition has been paid may be eligible for a refund. Refund requests can be made to the financial aid office, and if approved, the remaining funds will be disbursed to the student. This money can be used to cover living expenses, textbooks, or other essentials.

Applying Aid Towards Other Educational Expenses

Another option for excess financial aid is to use it towards other educational expenses. Applying aid towards other educational expenses allows students to offset costs such as housing, meal plans, transportation, or even study abroad programs. This can alleviate financial strain and enhance the overall educational experience.

Financial Aid Refund Process

When the total financial aid awarded to a student is more than the cost of tuition, it results in a financial aid refund. This refund often occurs when grants, scholarships, and loans surpass the amount needed to cover tuition, fees, and other educational expenses. Understanding the financial aid refund process and the associated policies and timelines is crucial for students and their families.

Understanding Refund Policies

Refund policies vary among educational institutions, but in general, they govern the procedures and regulations surrounding excess financial aid disbursements. Students should acquaint themselves with their school’s specific policies, as these guidelines dictate how and when refunds are issued, the criteria for eligibility, and any associated fees or restrictions.

Timelines For Receiving Refunds

Once tuition and fees are paid, any remaining financial aid is typically disbursed directly to the student. The timeline for receiving refunds can differ based on the school’s processes, with some institutions issuing refunds at the beginning of the semester, while others distribute them periodically throughout the term. It’s essential for students to be aware of these timelines to effectively budget and plan for their educational and living expenses.

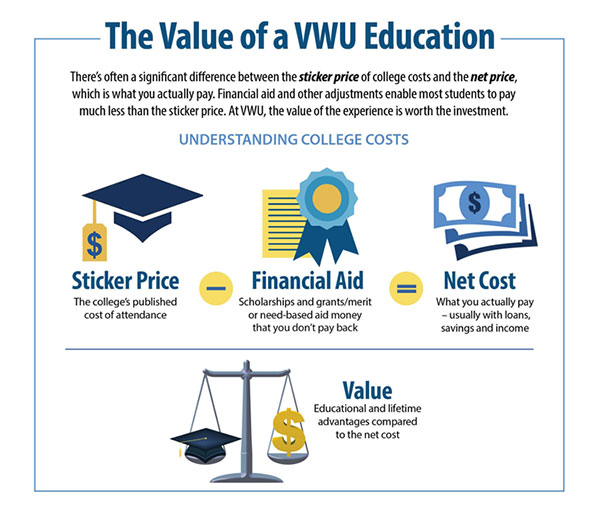

Credit: www.vwu.edu

Potential Consequences Of Misusing Excess Funds

The potential consequences of misusing excess financial aid funds can have long-term repercussions for students. It is important to understand the potential impact on future aid and the financial burden that may arise after graduation.

Impact On Future Aid

Misusing excess financial aid funds can have a significant impact on a student’s future eligibility for financial assistance. When students receive more aid than necessary, it may create a false perception of financial need. This can result in a reduction or even the elimination of future aid opportunities, as the student may be deemed as having sufficient resources to cover their educational expenses.

This loss of future aid can be particularly detrimental for students who rely on financial assistance to fund their education. It may force them to take on additional loans or seek alternative financial solutions, adding to their overall debt burden.

Financial Burden After Graduation

Misusing excess funds can also lead to a significant financial burden after graduation. Students may not fully realize the long-term implications of using these funds for non-educational purposes, such as unnecessary expenses or frivolous purchases.

Once students graduate, they often face the reality of loan repayments, interest charges, and other post-graduation expenses. If the excess funds were not used responsibly, this can exacerbate the financial strain and make it even more challenging to meet these obligations.

In addition, misusing excess financial aid may also impact a student’s ability to secure a job or pursue further educational opportunities. Employers and graduate schools may view a history of irresponsible financial behavior as a sign of poor judgment or irresponsibility, potentially hindering future career or academic prospects.

Planning For Excess Financial Aid

When your financial aid amount exceeds your tuition costs, it opens up opportunities for how you can strategically allocate these funds. Proper planning is essential to make the most out of this situation while staying within financial constraints.

Budgeting Strategies

Utilize excess financial aid through:

- Create a detailed budget for expenses

- Allocate funds for textbooks, supplies, and living expenses

- Consider saving or investing the surplus amount

Consulting Financial Aid Office

Engage with the financial aid office for:

- Understanding regulations on fund usage

- Seeking guidance on managing surplus responsibly

- Exploring additional financial aid options for future terms

Leveraging Excess Aid For Career Development

When financial aid exceeds tuition costs, students can leverage the excess funds for career development. This surplus aid can be used for investing in professional development opportunities, such as workshops, certifications, or internships, ultimately enhancing their career prospects and gaining practical experience in their field.

Investing In Professional Development

Using excess financial aid for career growth is beneficial. Attend workshops, conferences, or online courses.

Enhance skills in demand by employers. Increase job prospects and earning potential.

Savings And Investment Opportunities

Consider saving or investing extra funds wisely. Open a high-yield savings account.

Explore investment options like stocks or mutual funds. Consult with a financial advisor.

In Summary – Invest in yourself through ongoing learning. – Save or invest surplus aid wisely for your future.Community Insights And Experiences

When financial aid exceeds tuition, it can have a significant impact on students’ lives, providing opportunities for housing, books, and living expenses. Community insights and experiences shed light on the broader effects of this financial assistance, showing how it can alleviate financial stress and foster a more inclusive and supportive academic environment.

Financial aid that exceeds tuition can have a profound impact on students’ lives, extending far beyond the classroom. This section explores real stories and lessons shared by individuals who have experienced the surprises and opportunities that arise when financial aid exceeds tuition. With these community insights and experiences, you’ll gain a deeper understanding of how financial aid can truly transform lives.Real Stories And Lessons

In the realm of financial aid, real stories from students who have received more aid than expected provide invaluable insights and lessons for others. These firsthand accounts not only illustrate the impact of financial support but also shed light on unexpected challenges and triumphs. One student, Melissa, arrived at college with a financial aid package that covered tuition and more. Initially, she viewed the surplus as a safety net for unforeseen circumstances. However, as the year progressed and she became more involved in campus activities, she realized that these additional funds offered her the chance to pursue new opportunities. Through her experiences, Melissa learned the importance of exploring beyond the classroom. She used the surplus to join clubs, attend conferences, and even study abroad, broadening her horizons and deepening her understanding of the world. Melissa’s story serves as a reminder that financial aid can serve as a gateway to personal growth and development. Another student, David, experienced a similar situation with his financial aid exceeding tuition. With the additional funds, he decided to invest in a reliable laptop, enabling him to pursue digital arts, a passion he had nurtured since high school. Little did he know that this investment would eventually lead to a freelance career in graphic design, providing him with a source of income throughout his college years and beyond. David’s story highlights the importance of recognizing hidden opportunities that arise when financial aid surpasses tuition. By investing in tools or resources that align with their passions and interests, students can transform their hobbies into lucrative endeavors, paving the way to financial independence and personal fulfillment.Expert Recommendations

To make the most of financial aid that exceeds tuition, experts suggest several key strategies. These recommendations stem from years of experience navigating the realm of higher education and observing the transformative effects of surplus financial aid. 1. Create a Budget: Develop a realistic budget that incorporates not just tuition but also living expenses, extracurricular activities, and potential investments in personal development. By planning ahead, students can make informed decisions about how to allocate excess financial aid. 2. Seek Guidance from Financial Aid Offices: Reach out to your school’s financial aid office for personalized advice on managing surplus aid. They can provide insight into available resources and opportunities that may enhance your college experience. 3. Explore Professional Development Opportunities: Use surplus financial aid to invest in internships or workshops that align with your career goals. These experiences can bolster your resume and open doors to future employment opportunities. 4. Consider a Nest Egg: While it may be tempting to spend excess financial aid immediately, experts advise setting aside a portion as a nest egg for future expenses or emergencies. This safety net can alleviate any potential financial stress that may arise during your college journey. By leveraging these recommendations and learning from the experiences of others, students who find themselves with financial aid that exceeds tuition can make the most of their unique circumstances. The insights and lessons offered by the community provide invaluable guidance for embracing unexpected opportunities and transforming the college experience beyond the confines of the classroom.

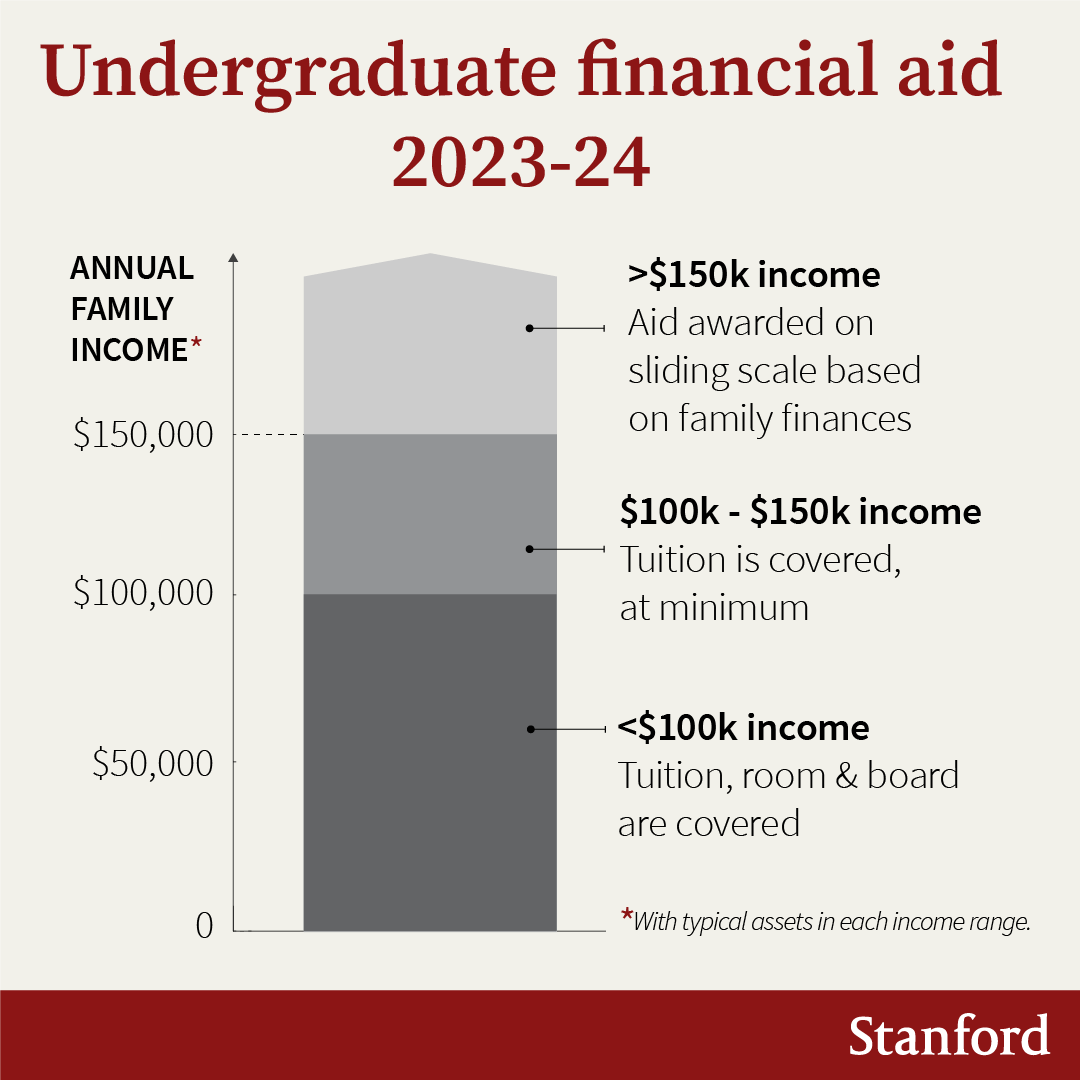

Credit: news.stanford.edu

Frequently Asked Questions Of What Happens When Financial Aid Is More Than Tuition

What Happens If Fafsa Is More Than Tuition?

If your FAFSA (Financial Aid) exceeds your tuition, you may have money left over. This leftover amount, called a refund, can be used for other education-related expenses like textbooks or housing. Remember to use it responsibly and prioritize your needs.

What Happens If You Have Excess Financial Aid?

Excess financial aid is refunded to you for educational expenses not covered by the aid.

What Happens If You Accept More Financial Aid Than You Need?

Accepting more financial aid than needed can lead to higher student loan debt in the future. It’s crucial to only borrow what is necessary to avoid unnecessary financial burden.

What Happens If My Student Loan Is More Than My Tuition?

If your student loan is more than your tuition, the excess funds may be used to cover other educational expenses like textbooks or housing. It is important to use the extra money wisely and not overspend, as you will still be responsible for repaying the entire loan amount.

Why Is Financial Aid Exceeding Tuition Important?

Receiving excess financial aid can help cover other college expenses like books and housing.

Conclusion

To conclude, when financial aid exceeds tuition, students have the opportunity to use the excess funds for various purposes. They can cover other educational expenses like textbooks, supplies, and technology, or allocate the surplus towards living costs such as rent and food.

This additional financial support grants students the ability to focus on their studies without the stress of financial constraints. Ultimately, it allows for a more well-rounded and enriched college experience.